I’m concerned not only about your craft and creativity, I’m concerned about your livelihood. As awful as the idea is, I associate the new year with taxes, and there are a few things I want to tell you about taxes.

If you are an apprentice or a dilettante, carry on with what you’re doing and don’t worry about any of this.

This post is for you if you were paid for your writing in 2023.

Cash Income

The minute I finished grad school in the late 90s, I knew that I needed to be an independent writer. I didn’t even try to apply for professor jobs. I made this dream work by moving into my grandmother’s empty, rent-free farmhouse and starting to sell my words. (Actually I was not selling the words, I was selling the unique way I put the words together.)

That was income. As long as the amounts were small and arrived as cash or checks, I didn’t have to worry about taxes.

But as soon as the jobs were larger and I received 1099s (as an independent contractor) then I had to become conversant with the U.S. Internal Revenue Service.

I needed to file a Schedule C, which reports income earned as a sole proprietor of a business. I filed this with my regular W-2s, if I had worked for an organization during the year.

You don’t need an LLC to file a Schedule C. This is important. If you receive income from your writing as a self-employed writer, you simply file Schedule C.

The form is simple.

You list income received during the year.

You list expenses.

You subtract #2 from #1.

You pay taxes on the rest.

When to File a Schedule C

The IRS says you need to file if you make more than $400 through self-employment. That’s asking a lot of the IRS, to be honest. The IRS wants to know about ANY money you make over $400, but they only get notified of payments to you if a 1099 has been filed or a large sum added to your bank account. (Don’t report me for saying that.)

Entrepreneur

In my early days as a writer I didn’t know that I was an entrepreneur. I used the terms “self-employed” or occasionally “sole proprietor,” but I didn’t upgrade my mindset to think “entrepreneur” or “small-business owner.”

Now I’m both of those.

To create an LLC and become a legal business entity took me another 20 years. Wow.

Business Expenses

What I really want to put on your radar is business expenses. If you have writing income and you file a Schedule C, you can include these expenses:

your subscription to The Rhizosphere

subscriptions to other journals and magazines that support your writing business

supplies such as journals, paper, printer ink, and other office necessities

postage for mailing anything related to your work. If you sell books online and you are reporting the income, then you can deduct the postage for delivering the books.

computer

software for the computer

costs of your internet domain

wifi fees

any other internet services that you pay for, which serve you as a writing entrepreneur (such as cloud storage)

fax machine and copier

travel expenses, including mileage and meals

other “ordinary and necessary” expenses for your writing business

Home Office Deduction

Whatever percentage your work space takes up in the total square footage of your home can be deducted as a percentage of total home expenses. As TurboTax says in its Tax Tips for Freelance Writers, “For example, if your dedicated work space takes up 15% of the total square footage of your home, you can deduct 15% of your mortgage principal or rent payment, utilities, and insurance.”

This doesn’t happen if you work on the sofa, however. The space has to be dedicated.

Self-Employment Tax

You will have to pay your own taxes for this income. They are high. It will cost a chunk. But this feeds into your Social Security, so you’ll be happy for it later on.

Audits Are No Fun

I have been audited once. It is not a pretty scenario. In this case I had begun to use Turbo Taxes and did not understand the app, so I reported the same income twice. That really messed up the system and took two years to straighten out. After that I hired a certified public accountant. I was brave to do my own taxes for all those years (to save money) but my CPA only charged me $350 the first year and she saved me $5,000.

Remember Gay Hendricks’s 4 zones? One is the Zone of Incompetence. Taxes fall into the Zone of Incompetence for me and for many creatives. My CPA is infinitely more competent in this area, and hiring her was one of the best decisions I’ve made financially.

Note

All this is how I understand US taxes to work, but

look up specific problems on the IRS website

please go to a certified public accountant or other tax professional for competent advice.

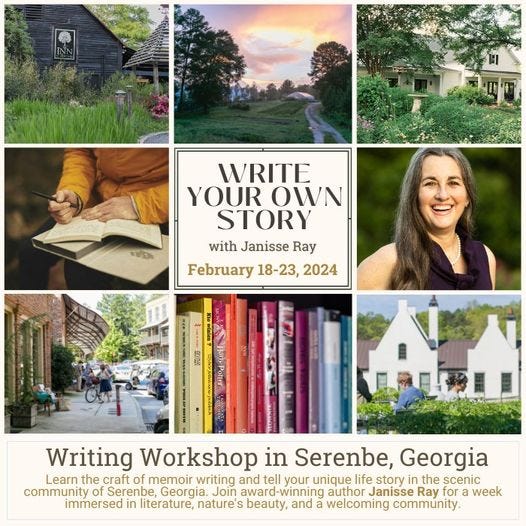

In Person | 5 Days | Serenbe | Atlanta, GA

I spoke yesterday with the organizer and there are a few spots left.

In Person | 1 Day | Funky Little Flower Farm | Beech Island, SC

Happy New Year to You

Thanks for being here, on this path. The year 2024 is going to be a “magical swirl,” as a friend predicted. Tie your hair down.

Great advice, and I plan to use it someday! I am interested in the March workshop in Aiken - didn't find a link to sign up here on on your website, though I did find the info.

I remember your grandmother's little farmhouse. That place was charming. Also ... Zone of Incompetence is a great phrase. Anything that involves numbers and math falls into that category for me. Thanks for all these tips.